NCW Blog

All You Ever Wanted to Know About Insurance

Securing Cargo for Safe Transportation

Thursday, January 28, 2021

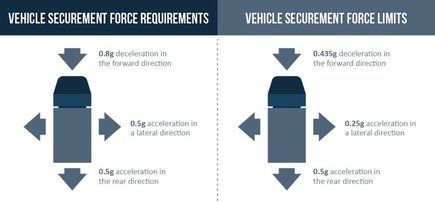

Securing Cargo for Safe Transportation This article focuses on Federal Guidelines for securing cargo, but this is also a very good guide for non-DOT cargo securement. Shifting cargo is one of the most common hazards in...

Top 10 Most Dangerous Jobs of 2020

Tuesday, January 12, 2021

Top 10 Most Dangerous Jobs of 2020 These are the most dangerous occupations in the U.S., as measured by fatal work injury rate. The first question one might ask when examining a list of the United States’ most dangerous...

Mandatory Vaccine Policies May Have Workers Comp Implications

Wednesday, January 6, 2021

Mandatory Vaccine Policies May Have Workers Comp Implications By: Angela Childers The COVID-19 vaccine rollout has begun in health care and senior living facilities across the U.S., and employers in many industries are...

2020, What a Year!

Sunday, January 3, 2021

2020 What is there left to say? You don't need me to tell you about the COVID pandemic and how catastrophic it has been or enumerate the ways the coronavirus has taken over our lives. We're all tired of lockdowns,...

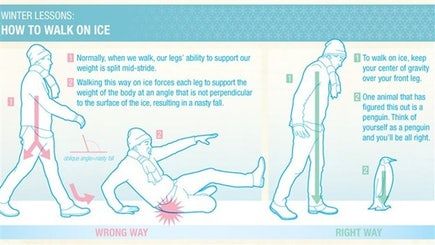

De-icing Outdoor Walking Surfaces in Winter

Wednesday, December 30, 2020

Keeping outdoor walking surfaces-such as parking lots and sidewalks-clear of ice in the winter is a crucial practice at many workplaces. Not only does ice removal offer aesthetic benefits, it can also help keep you,...

IRS Announces 2021 Standard Mileage Rates

Monday, December 28, 2020

On December 22, 2020, the IRS issued the 2021 optional standard mileage rates, which are used to calculate the deductible costs of operating an automobile for business, charitable, medical or moving purposes. The 2021...

Onboarding New Employees in the COVID-19 Era Takes Extra Planning, Effort

Monday, December 14, 2020

You only get one chance to make a first impression on a new employee. Despite the fact that initial interactions are often now remote instead of in person, welcoming a new employee to your company is vitally important....

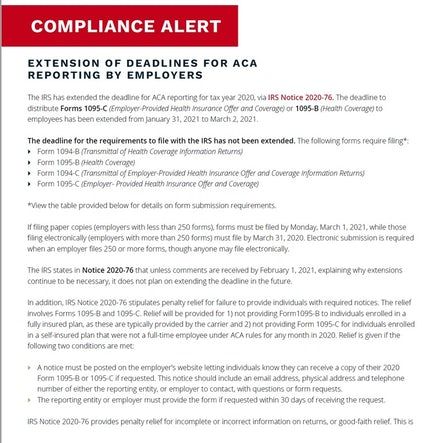

Extension of Deadlines For ACA Reporting By Employers

Thursday, December 10, 2020

The information contained in this document is intended for educational purposes and to provide a general understanding of regulatory events, legislative changes and the law - not to provide specific legal advice. Source:...

Did you know that you could already be filing for your Advance Credits on Emergency Paid Sick Leave monies paid to employees under FFCRA?

Tuesday, December 8, 2020

Did you know that you could already be filing for your Advance Credits on Emergency Paid Sick Leave monies paid to employees under FFCRA? Eligible employers can use Form 7200, Advance Payment of Employer Credits Due to...

CDC Announces Shorter Quarantine Guidelines After a COVID-19 Exposure

Friday, December 4, 2020

During a recent media briefing, the Centers for Disease Control and Prevention (CDC) announced an update to quarantine guidelines, offering options for shorter quarantine periods. The CDC’s updated guidance allows for...